voting right in 1935 election

Assessed any income tax, municipal tax in Calcutta, municipal tax of at least 8 annas, public works cess of at least 8 annas, chaukidari tax of at least 6 annas, or union rate of at least 6 annas; occupied a house of annual value at least Rs 42; passed matriculation exam of any university; retired, pensioned or discharged officers or soldiers; widows and mothers of officers and soldiers; literate women; wives of qualified voters (who are subject to much stricter property limits than above). No men allowed to vote in the Muhammadan women's constituency. Madras Madras City: paid any tax in previous year or occupied a house of at least Rs 60 annual value; Other areas: paid any income tax or at least Rs 3 of other taxes or owned or leased land with annual rent value of at least Rs 10; retired or pensioned officer of armed forces. Assessed any income tax, profession tax, property tax, house tax (or tenants of such property) or motor vehicles tax; registered landholder or occupancy ryot; leased immovable property worth at least Rs 100 in annual rent (Rs 50 in rural areas); literate persons; retired, pensioned or discharged officers or soldiers; widows and mothres of officers and soldiers; wives of qualified voters (subject to stricter property limits than above). Bombay (included Sind in 1919) Occupied a house with annual rental value of at least Rs 36 (Rs 120 in Bombay and Karachi cities; Rs 24 in Panch Mahals or Ratnagiri districts); paid any income tax; retired or pensioned officer of armed forces; monthly wages of at least Rs 40 for Bombay city textile workers; owned or leased land paying at least Rs 32 in land revenue (Rs 16 in Panch Mahals, Ratnagiri and Upper Sind Frontier). Owners and tenants on land assessed at least Rs 8 in land revenue; owners or tenants of houses with annual rental value of at least Rs 18 (Rs 60 in Bombay city) or capital value of Rs 750; those who have passed the matriculation of the University of Bombay; retired, pensioned or discharged officers or soldiers. United Provinces Occupied a house with annual rental value of at least Rs 36, or paid municipal tax on income of at least Rs 200; paid any income tax; retired or pensioned officer of armed forces; owned land paying at least Rs 25 in land revenue; tenants paying at least Rs 25 in rent for permanent tenure holder or fixed rate tenants, and Rs 50 for others. Assessed any income tax; municipal tax on income of at least Rs 150; owner or tenant of a house with rental value at least Rs 24; owns land with land revenue of at least Rs 5 (or under-proprietor in Oudh of same); tenant of land with rent at least Rs 10; special provisions for Kumaon; passed the upper primary examination; retired, pensioned or discharged officer or soldier; widows and mothers of officers and soldiers; literate women; wives of qualified voters (with much stricter property limits than above). Eligibility Rules to Vote (non-Special Interest Constituencies) Province 1919 Act 1935 Act Punjab Owned or occupied property of at least Rs 96 in annual rental value (or total value Rs 4000); paid municipal tax of at least Rs 50; paid any income tax; retired or pensioned officer of armed forces; owned or leased land paying at least Rs 25 in land revenue; was an assignee of land revenue of at least Rs 50. Assessed any income tax; direct municipal tax of at least Rs 50; profession tax or district board tax of at least Rs 2; owner or occupancy tenant with land revenue assessed at least Rs 5; assignee of land revenue of at least Rs 10; tenant of at least 6 acres of irrigated land or 12 acres of unirrigated land; owned non-land immovable property worth at least Rs 2000 (Rs 50 for SC); tenant of immovable property with annual rental value at least Rs 60 (Rs 36 for SC); zaildars, inamdars, sufedposh or lambardar; attained the primary educational standard; retired, pensioned or discharged officers and soldiers; widows and mothers of officers and soldiers; wives of qualified men (with much higher property limits than above); literate women and SCs. Bihar (included Orissa in 1919) Paid municipal tax of at least Rs 3; paid any income tax; retired or pensioned officer of armed forces; holds estate paying at least Rs 12 in local cess; holds a tenure assessed at least Rs 100 for local cess; holds land as raiyat paying at least Rs 48 in land revenue (Rs 16 in Orissa and Chota Nagpur divisions, Rs 64 in Patna division and Munghyr district, Rs 24 in Santhal Parganas); paid Bengal Local Self-Government Act tax of at least Rs 1-8-0. Assessed any income tax; municipal tax of at least Rs 1-8-0; chaukidari tax of at least 9 annas; occupies land or buildings with annual rent at least Rs 24 (Jamshedpur); holds land with rent of at least Rs 6 or cess of at least 3 annas (non-Jamshedpur); passed matriculation exam of any university; retired, pensioned or discharged officers and soldiers; widows and mothers of officers and soldiers; wives of qualified men (with much higher property limits than above); literate women. No men can vote in the Muhammadan women's constituency. Central Provinces and Berar Owner or tenant of a house of annual rental value at least Rs 36; paid municipal tax on income of at least Rs 200; paid any income tax; retired or pensioned officer of armed forces; lambardar of a mahal; owns estate of land revenue at least Rs 100; holds a tenure assessed at least Rs 50 in annual revenue (Rs 40 in Bhandara, Balaghat, Nimar, Chhindwara and Seoni districts; Rs 30 in Raipur, Bilaspur, Drug, Chanda and Betul districts). Assessed any income tax; haisiyat tax of at least Rs 75; holds estate of land revenue at least Rs 2; owner or tenant of a building with annual rental value of at least Rs 6; watandar patel/patwari; registered deshmukh/deshpandia/lambardar; passed middle school examination; retired, pensioned or discharged officers and soldiers (also including Nizam's soldiers); widows and mothers of offiers and soldiers; literate or primary educated women; wives of qualified men (with higher property limits than above). SCs qualified if he is a kotwar, jaglia or village mahar holding office. Province 1919 Act 1935 Act Assam Paid municipal tax of at least Rs 3 (Rs 2 for Nowgong, Rs 1-8-0 for Sylhet, Rs 1 for rural constituencies); paid any income tax; retired or pensioned officer of armed forces; assessed tax of at least Rs 1 under Bengal Municipal Act 1876; owned land assessed at land revenue of at least Rs 1. Assessed any income tax; municipal tax of at least Rs 2 (Rs 1-8-0 in Sylhet, Rs 1 in small towns); chaukidari tax of at least 8 annas in Sylhet, Cachar and Goalpara districts; owns land with land revenue at least Rs 7-8- 0; pays local rates of at least 8 annas; rented land of at lesat Rs 7-8-0 in Lakhimpur, Sibsagar, Darrang, Nowgong, Kamrup and Garo HIlls districts; passed middle school examination; retired, pensioned or discharged officers and soldiers; widows and mothers of offiers and soldiers; literate women; wives of qualified men (with higher property limits than above). No man can vote in constituencies reserved for women. NWFP No legislative assembly. Assessed any income tax; municipal tax of at least Rs 50; district board tax of at least Rs 2; owned immoveable property of at least Rs 600; tenant of immovable property with annual rental value of at least Rs 48; owner or tenant of at least 6 acres irrigated land or 12 acres unirrigated land or land assessed to land revenue of at least Rs 5; assignee of land revenue of at least Rs 10; zaildars, inamdars or lambardar; passed middle school examination; retired, pensioned or discharged officers and soldiers; widows and mothers of offiers and soldiers; literate women; wives of qualified men (with higher property limits than above). Orissa No separate legislative assembly; see Bihar above. Assessed any income tax; municipal tax of at least Rs 1-8-0; chaukidari tax of at least 9 annas (Cuttack, Puri, Balasore districts and Angul subdivision); pays rent or land revenue of at least Rs 2 (Rs 1 in Sambalpur); passed matriculation exam of any university; retired, pensioned or discharged officers and soldiers; widows and mothers of officers and soldiers; wives of qualified men (with much higher property limits than above); literate women. Sind No separate legislative assembly; see Bombay above. Owners, permanent tenants and alienees on land assessed at least Rs 8 in land revenue; Hari cultivators on land assessed at least Rs 16 in land revenue; owners or tenants of houses with annual rental value of at least Rs 18 (Rs 30 in Karachi city) or capital value of Rs 750; those who have passed the matriculation of the University of Bombay; retired, pensioned or discharged officers or soldiers; widows and mothers of officers and soldiers; literate women; wives of qualified voters (who are subject to much st

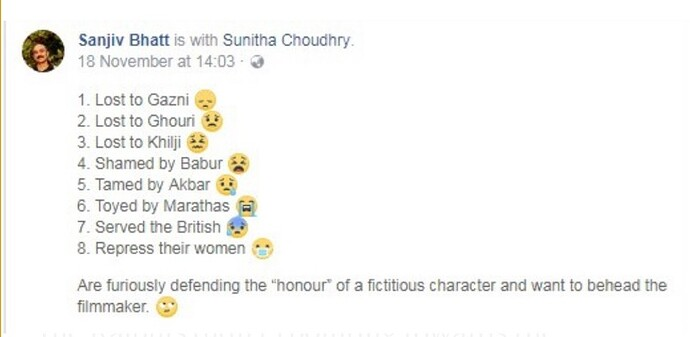

Comments

Post a Comment